Company Profile

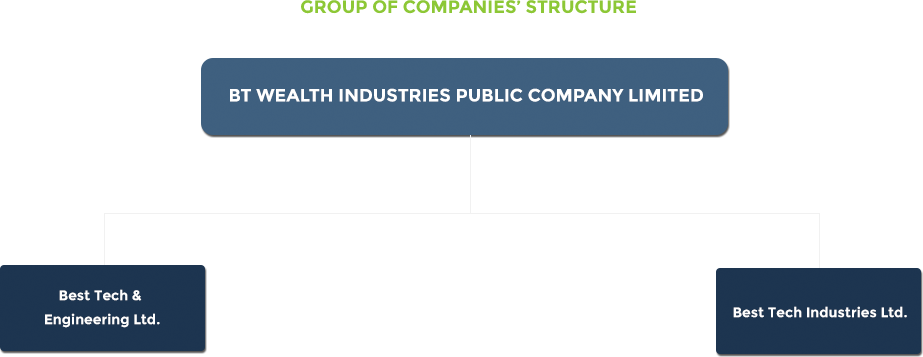

BT Wealth Industries Public Company Limited (“BTW”) wholly owns Best Tech & Engineering Ltd. (“BTE”), a major offshore steel fabricator in Thailand.

BTE has engaged in steel fabrication business for project construction in various heavy industries, such as, mining, natural gas and petroleum, and power, in both domestic and international sites.

BTE steel fabrication can be categorized into 2 major products, Modularization and Parts Fabrication serving either Engineering Procurement and Construction (“EPC”) contractors or project owners.

In addition to core business, BTW has also invested in 1 other subsidiaries: Best Tech Industries Ltd. (“BTI”) to support future expansion of the steel fabrication business.

Vision

Strengthen balanced management and business operations. Increase the potential for long-term sustainable business operations by focusing on reducing production costs while maintaining the production of quality products and providing good service and after-sales service coupled with social and environmental responsibility.

Sustainability Mission and Strategy

Seek investment in projects with a decent return on investment and continuity of income to create opportunities and expand business.

Continuously improve the quality of service in order to create the maximum customers’ satisfaction.

Develop staff to be competent and efficient, support new technologies by managing and expanding business opportunities.

Promote good corporate governance and create a culture of responsible business practices.

Manage partners for opportunities and business growth together.

environmental impacts and promote cost-effective resource utilization.

BTW Group of Companies History

35 years in operation

1987

BTE was established with an initial registered capital of THB 2 million to conduct business of trading material, equipment and piping system for customers in natural gas and petroleum, power and other heavy industries.

Explore more1995

Chachoengsao Workshop

The first factory has been constructed at Chachoengsao District, Chachoengsao Province for manufacturing piping system used in power plants.

2002

Changi Water Reclamation

BTE was awarded by 8 EPC contractors for parts fabrication works of Changi Water Reclamation Project in Singapore including coolant tanks, air receiver pressure vessels, hoppers, walkway structures and etc. with a combined contract value of SGD 23.1 million.

2008

Sattahip Workshops and Yards

The waterfront factory was constructed at Sattahip commercial port, Sattahip District, Chonburi Province to support steel fabrication of large-size modularization work.

Deaerator Module - Golar Winter Renovation of FSRU

Boiler Module - Peregrino FPSO

BTE was awarded by Aalborg Industries for modularization works of Golar Winter Renovation of FSRU (Floating Storage and Regasification Unit) Project and Pergrino FPSO (Floating Production Storage and Offloading) Project for a large-scale natural gas and petroleum drilling project in Brazil with a combined contract value of EUR 4.8 million.

2009

Lihir Gold Mine -MOPU

BTE was awarded by Robt Stone for modularization work of Lihir Gold Mine - Million Ounce Plant Upgrade Project under a large gold mine in Papua New Guinea with a contract value of AUD 8.6 million.

2011

2 BOI certificates were granted for Chachengsao Factory and Sattahip Factory with a main privilege of 8-year corporate income tax exemption for productions of machinery, equipment, parts and steel fabrication for construction or manufacturing industry or platform repair.

Conveyer Module

Train Load Out Module

BTE was awarded by 4 EPC Contractors, namely, RCR Resource, Laing O’Rourke Australia Construction, Terra Nova Technologies and Cimeco for modularization works of Ore Processing Facility, Crushing Hub, Conveyor, and Train Load Out under Solomon Iron Ore Project, a large iron ore mine in Australia with a combined contract value of USD 218.1 million.

2012

BT Wealth Industries Co., Ltd. was established with an initial registered capital of THB 5 million to conduct business of leasing machinery and equipment for steel fabrication work.

2014

Iron Ore Processing Plant

BTE was awarded by Samsung C&T Corporation for modularization work of Roy Hills Iron Ore Project, a large iron ore mine in Australia with a contract value of USD 105.6 million.

BTW increased its registered capital to THB 300 million and acquired 99.5% issued shares of BTE from its shareholders.

2015

BTW acquired 90% share in BTO to support the company’s future investment in solar power plant and/or renewable energy power plant.

BTI was established as a wholly owned subsidiary of BTW to support an expansion in steel fabrication business.

BTW has converted into a public limited company and increased its registered capital from THB 300 million to THB 378 million for the purpose of initial public offering (IPO).

BTW acquired 100% share in GCE to support the company’s future investment in solar power plant and/or renewable energy power plant.

2016

BTW has changed its share par value to THB 0.50 per share and reserved 156 million authorized common shares for IPO and listing on the mai stock market.

BTW expanded its scope of business to cover the provision of service as a power plant EPC Contractor

BTI was granted the investment promotion certificate for the Chachoengsao Workshop and the Sattahip Workshops and Yards to promote investment in the manufacturing of structures used for construction or industrial projects.

2017

Best Tech obtained a quality standard certificate of JIS - H Grade from Japan Steel-Fabrication Appraisal Organization (JSAO), a certified standard for the construction of steel structures for large buildings in Japan.

2018

Best Tech receives the transfer of privileges from the investment promotion certificates for Chachoengsao and Sattahip factories, to promote investment in the manufacture of steel structures for construction or industrial works, from BTI.

2019

The Extraordinary General Meeting of shareholders of Global Clean and BT Owl passed a resolution approving the dissolution of the business, which already registered to liquidate the business with the Ministry Commercial.

2020

Best Tech increased its registered capital by 2.2 million shares or THB 220.0M by selling to existing shareholders at the price of THB 100 per share, resulting in a total registered capital of 3 million shares or THB 300M.

2023

Best Tech increased its registered capital by 1 million shares or THB 100M by selling to existing shareholders at the price of THB 100 per share, resulting in a total registered capital of 4 million shares or THB 400M.

2024

Best Tech increased its registered capital by 1 million shares or THB 100M by selling to existing shareholders at the price of THB 100 per share, resulting in a total registered capital of 5 million shares or THB 500M.